Trading Instruments

All the various kinds of assets and contracts that can be traded are referred to as trading instruments. Various sorts of trading instruments exist, some of which are more well-known than others. They include indices, currencies, forward contracts, shares, and more.

We only use just few of the popular trading instruments, which often experience substantial daily trading volumes.

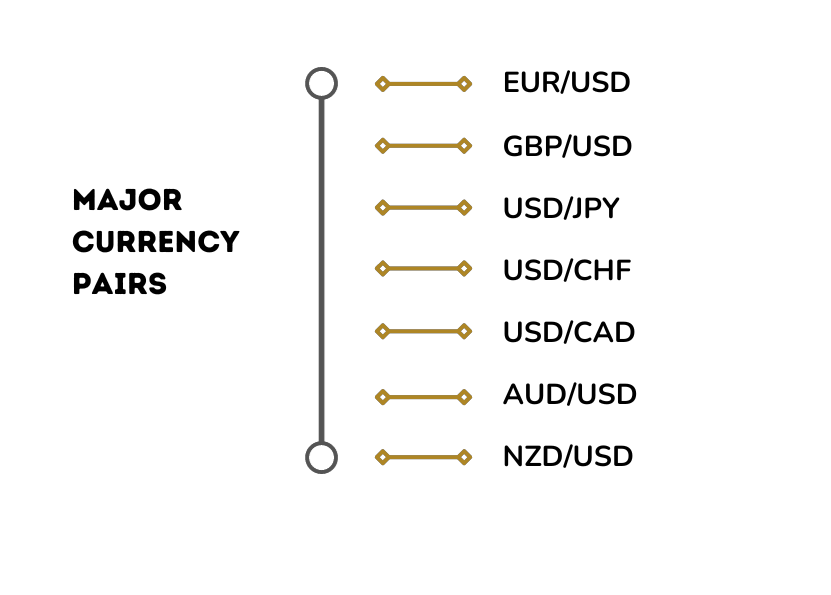

Forex Currency Pairs

Because you instantly sell or buy another currency when you buy or sell one, currencies are always exchanged in pairs. There are two currencies in every currency pair: a base currency and a quotation currency. The base currency always comes first, and the quote currency always comes after. The amount of the quote currency you must spend to buy one unit of the base currency is shown as the price for each currency pair.

As an instance, in the currency pair EUR/USD, EUR serves as the base currency and USD as the quote currency. One euro is worth 1.20 US dollars if the quote price was 1.2000. Enso Assets trade all the major currencies mentioned

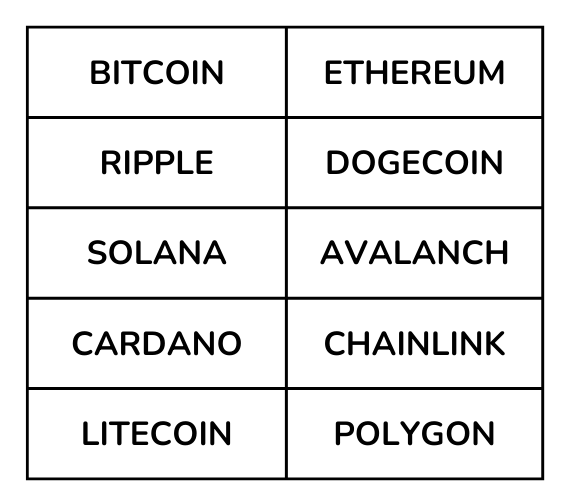

Cryptocurrency Trading

The purchasing and selling of cryptocurrencies on an exchange is known as cryptocurrency trading. With us, you can trade cryptocurrencies by using CFDs (contracts for difference) to speculate on their price changes. Because CFDs are leveraged derivatives, you can trade changes in the price of cryptocurrencies without acquiring any of the underlying coins. When trading derivatives, you have the option to go long (or "buy") if you believe a cryptocurrency's value will increase or short (or "sell") if you believe it will decrease. In contrast, you purchase the actual coins when you purchase cryptocurrencies on an exchange. To initiate a position, you must open an exchange account, deposit the full asset value, and keep the cryptocurrency tokens in your personal wallet until you are ready to sell.

Enso Assets trades the aforementioned cryptocurrency by holding it and making predictions about its future value.

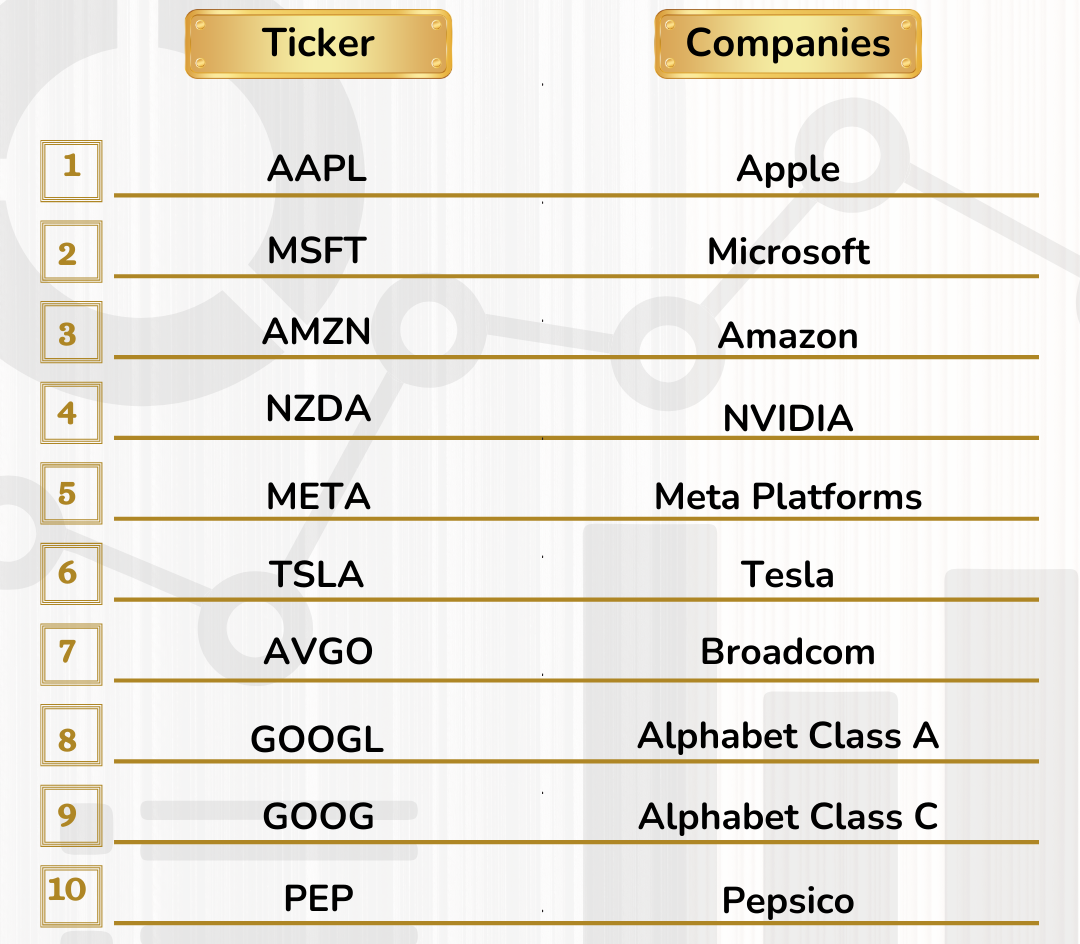

US Stocks and Bonds

The largest publicly traded firms in the NASDAQ Composite index are given here, ranked by market capitalization, along with their ticker code.

It is advised that you first invest in our well-diversified portfolio plan before beginning to purchase assets like equities and bonds. In fact, stocks and bonds are two of the most traded asset classes, each of which can be purchased through a variety of platforms, marketplaces, or brokers. Additionally, there are significant, fundamental distinctions between stocks and bonds. Enso Assets focuses on the top Nasdaq 100 listed equities and bonds.

Commodities

One of the oldest markets still in operation is the commodities market. In truth, the Amsterdam Stock Exchange, which opened in 1530, is frequently referred to as a commodities market and is thought to be the world's first stock exchange.

A commercial product that grows naturally in the ground or is produced through agricultural cultivation is referred to as a commodity. Because they are utilized as inputs in the manufacturing process, commodities have a significant role in establishing the pricing of other financial markets. As a result, the prices of commodities have an impact on national economies in general and publicly traded corporations in particular. Commodity price changes frequently have an impact on the entire supply chain.

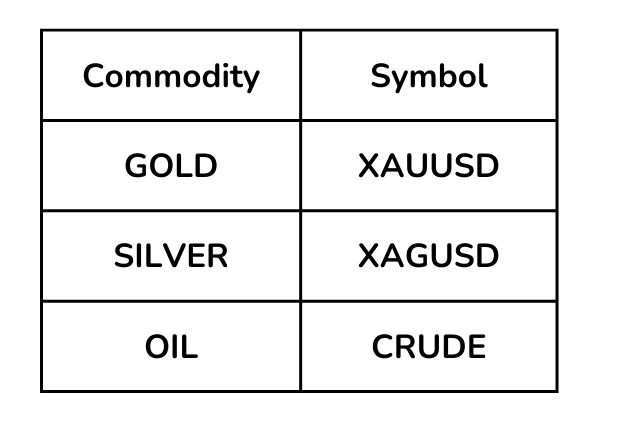

Our primary trading commodity ins Gold, Silver and Crude Oil. According to statistics, the XAUUSD pair is one of the most popular ones on Forex.

Indices

An index is used to provide data regarding product price changes in the financial, commodity, and other markets. Stock, bond, T-bill, and other types of investment price changes are tracked by financial indexes, which are built specifically for this purpose. Stock market indices are designed to reflect the general trends in the equity markets. The process of choosing a collection of stocks that are indicative of the entire market or a specific industry or market segment results in the creation of a stock market index. A base period and a base index value are taken into consideration while calculating an index.

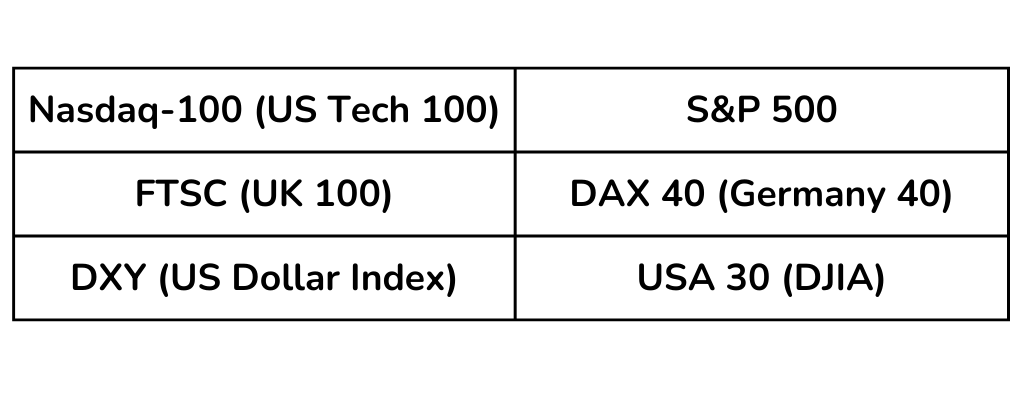

We often employ the following indices-