Asset Allocation: Understanding Its Importance

Investing is an art form in which achieving a balance between various investment kinds is crucial for increasing profits while reducing risk. Bonds or gold perform better at times, while stocks perform best at others. Investors want to combine these assets in a strategy that reduces market fluctuations and produces consistent growth over an extended period of time.

A key concept in investing is asset allocation, which describes how a shareholder splits their holdings among several asset classes, including stocks, bonds, real estate, and cash equivalents.

Why Asset Allocation Is Crucial

Diversification and Risk Management

- Diversification: By spreading investments across various asset classes, investors can reduce the risk of significant losses. Different asset classes often perform differently.

- Risk Management: Proper asset allocation helps manage risks while stocks offer high returns, they also come with higher volatility. Bonds, on the other hand, are more stable but offer lower returns.

Aligning with Financial Goals

- Short-Term Goals: For goals within the next few years, a more conservative allocation with a higher proportion of bonds and cash can help preserve capital.

- Long-Term Goals: For long-term goals like retirement, a higher allocation to stocks can be beneficial due to their potential for higher returns over time.

Managing Market Volatility

- Market Fluctuations: Markets are inherently volatile. A well-allocated portfolio can help smooth out the ups and downs, providing more stable returns over time.

- Emotional Investing: Proper allocation can help investors stay the course during market turbulence, reducing the temptation to make impulsive decisions based on short-term market movements.

Maximizing Returns

- Efficient Frontier: Asset allocation aims to optimize the balance between risk and return. The efficient frontier is a concept in modern portfolio theory that represents the set of portfolios offering the maximum possible expected return for a given level of risk.

- Risk-Adjusted Returns: By strategically balancing different asset classes, investors can aim for higher risk-adjusted returns.

Adaptability and Flexibility

- Life Changes: As an investor’s financial situation, goals, and risk tolerance change, their asset allocation should be adjusted accordingly. This might mean shifting more assets to bonds as retirement approaches.

- Market Conditions: Changes in market conditions may also necessitate adjustments in asset allocation to maintain the desired risk-return profile.

Compounding Growth

- Long-Term Growth: Proper asset allocation can take advantage of compounding growth, especially with a higher allocation to equities, which historically provide higher returns over long periods.

- Time Horizon: The longer the time period, the more pronounced the effects of compounding. Even modest returns can accumulate to substantial sums over decades.

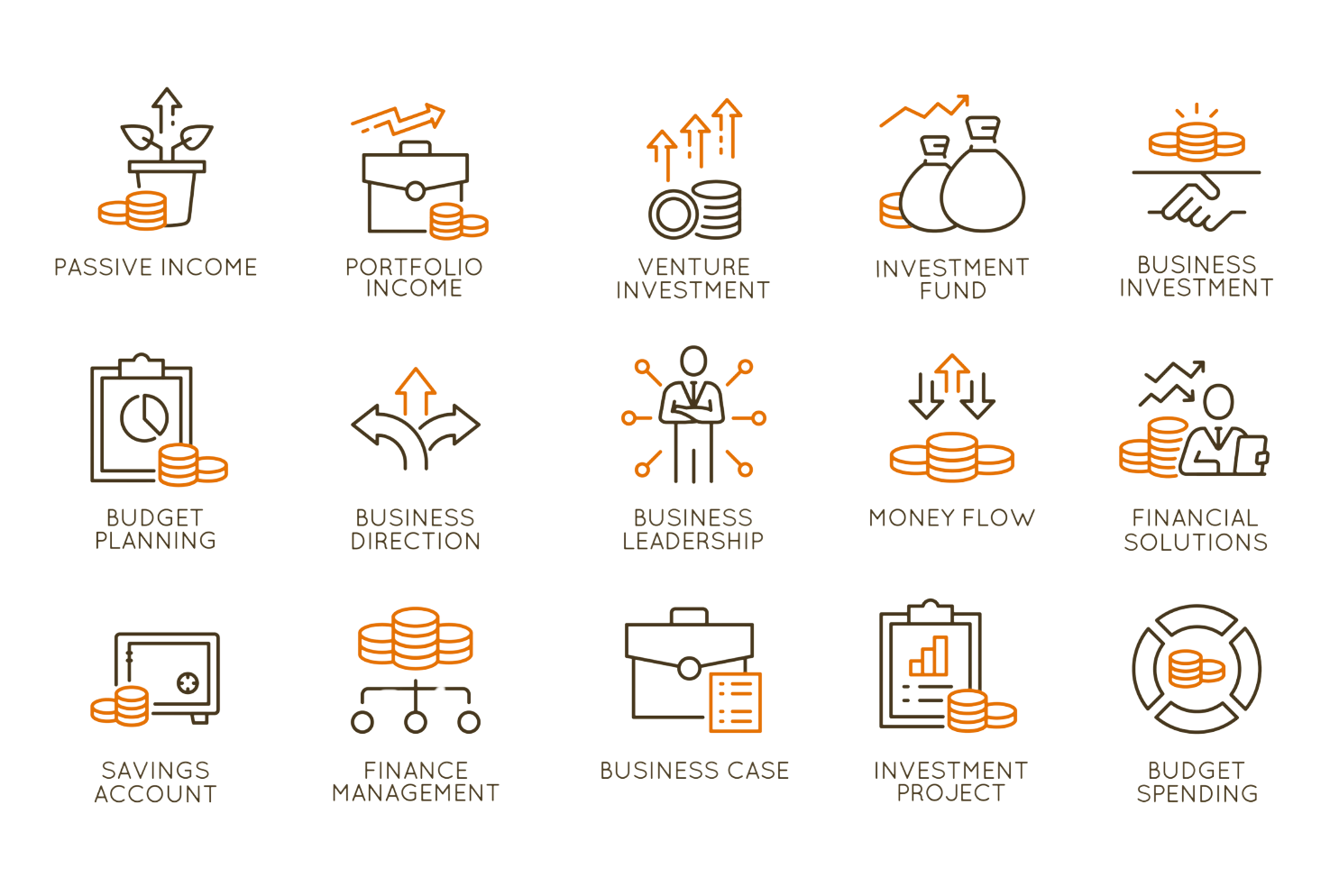

Assets Classes Considered For Allocation

The four main asset classes typically considered in an investment portfolio in which the above vectors include are:

Stocks (Equities):

- Description: Represent ownership in a company and a claim on part of the company's assets and earnings.

- Characteristics: Potential for high returns, higher risk and volatility, potential for capital appreciation, and dividends.

Bonds (Fixed Income):

- Description: Debt securities issued by corporations, municipalities, or governments to raise capital, where the issuer pays interest to the bondholders.

- Characteristics: Generally lower risk and returns compared to stocks, provide regular interest payments, and return of principal at maturity.

Real Estate:

- Description: Investments in physical properties such as residential, commercial, or industrial real estate, or through Real Estate Investment Trusts (REITs).

- Characteristics: Provides potential for income through rents and appreciation of property value, acts as a hedge against inflation, and offers diversification benefits.

Cash and Cash Equivalents:

- Description: Highly liquid assets that can be quickly converted into cash, including savings accounts, money market funds, and short-term government bonds.

- Characteristics: Lowest risk and return, provides stability and liquidity, and often used for emergency funds or short-term needs.

Asset allocation is a cornerstone of a successful investment strategy. It involves a deliberate approach to balancing risk and reward, aligning investments with individual goals and time horizons, and maintaining flexibility to adapt to changing circumstances. By understanding and implementing effective asset allocation, investors can enhance their potential for achieving financial objectives while managing risks prudently.