Gold Weekly Forecast History - Enso Assets

23 January 2024

6:00 AM

In terms of gold, we anticipate a discount price from the current range to 1970. After sell side liquidity is cleared, we will need to look into the price movement more closely after fundamentals. There are many geopolitical events taking place, thus any gold position should ideally be backed by a solid risk management strategy.

15 January 2024

6:00 PM

Given the current geopolitical concerns, we are bullish on gold and believe it will at least reach 2080 this week and likely reach an all-time high in the coming week. Our buy level is below 2050.

01 January 2024

6:45 PM

GOLD have to be investigated further more the weekly price action.

17 December 2023

6:15 PM

According to our previous forecasting, gold reached our target level of 2150 and then better than expected retraced to the 1980 level. Being positive on gold, we anticipate a long-term minimal decline to the 2013–2010 level, with the goal of reaching the 2060 level.

03 December 2023

2:30 PM

Gold as described in Tapped 2075 is our goal level. It didn’t achieve a deep retracement to our long-term point of interest, but we have made a solid intraday move. Given that December is here, the market will likely consolidate. In order to continue to 2150, we anticipate clearing liquidity at the 2080 level and a retracement to the 2008 level.

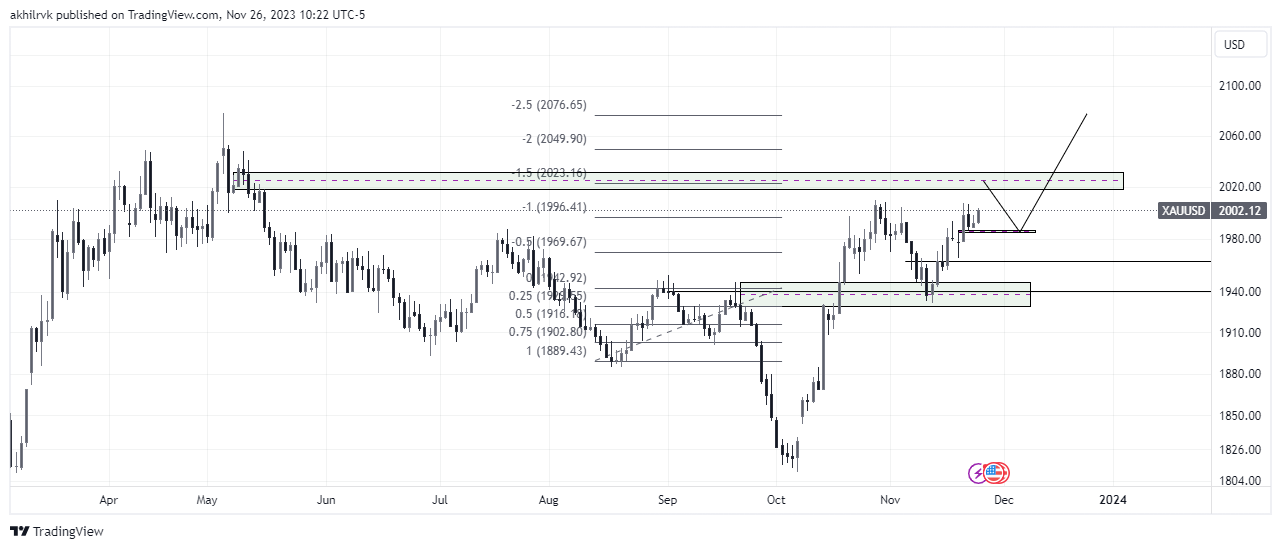

26 November 2023

6:00 PM

For gold, we predict a short-term peak at the level of 2023, a decline to our point of interest (POI) at 1985, and a goal price of 2075.

13 November 2023

10:00 AM

As anticipated, gold fell to our POI for BUY last week. However, we search for Long since we have liquidity at the extreme 1894 level and the decisional price level 1913.

06 November 2023

7:30 AM

As we stated last week, we are bullish on gold in the long term, but we predict a short-term dip to the 1940 level before looking for additional long positions to target the 2080 level.

29 October 2023

6:50 PM

Gold, as we discussed last week, is reaching our possible resistance level in 2018. We should expect a reversal back to 1993 for Long Targeting All Time High on Gold from this level. If there is a significant correction in gold, 1940 will be the optimum level to enter a long position if and only if 1993 is broken.

22 October 2023

6:45 PM

Gold found support around the 1904 level last week, as expected, and the aim was 1993, with a high of 1997 before falling. The next buy level for gold is around 1940-1934. We expect a short-term high in 2018, with a goal level of 2085.

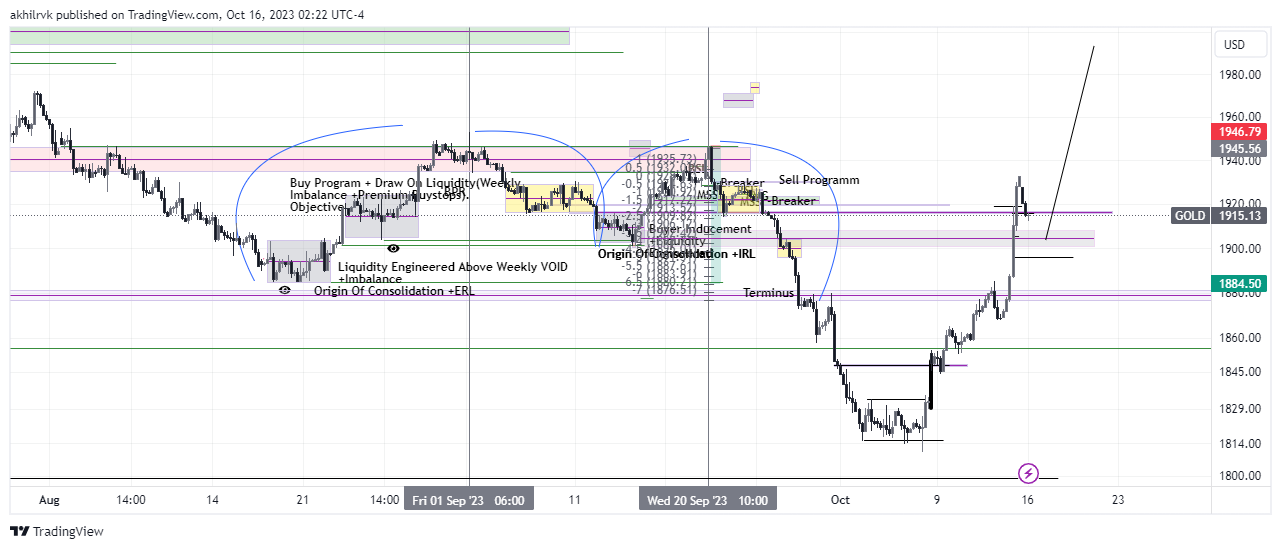

16 October 2023

9:50 AM

Gold is regarded as the Safe Haven since there is a lot of uncertainty and an unforeseen geopolitical event happening right now. We have a Significant Upside Gap from last week’s opening. Therefore, we must change our Bias to Bullish. We’ll be looking to engage Long position at about 1904 Level focusing on 1993+.

09 October 2023

6:50 AM

We foresee short-term bullishness in gold as the DXY retraces following a three-month uptrend. We will watch for a short and continuation below the 1803 level for gold at the 1848 level.

30 September 2023

7.00PM

Gold is likely to persist Bearish Eliminate Low Resistance Liquidity below 1809. DXY is looking exceedingly bullish. More bearishness in gold is likely to continue until we have a definite USD Report that is coming in unfavorable for the currency. The entire forecasted goal for the prior week has been met.

25 September 2023

7:50AM

According to our earlier findings on XAU/USD Forecast- Prior to the FOMC, the market drove gold’s price higher, although it has since fallen from the extreme level. We anticipate that Gold will keep falling until it eliminates Sell Side Liquidity that is positioned below 1885 and extending to 1877. We expect the bearish order flow and bullishness in DXY to persist until the following NFP. We can consider adding more sell positions if the market offers the 1930 Level.

17 September 2023

7:50PM

Gold is anticipated to decline after formation of 1932-1934 peak on Monday or Tuesday. Taking away Buy side Liquidity above 105.900 demonstrated by CXY bullishness. Therefore, we anticipate a decline in gold below 1885 and a maximum decline to 1877. Also a possible reversal to print in all-time high in the following leg.